san francisco payroll tax and gross receipts

200M gross receipts 50 payroll. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

San Francisco imposes a Payroll Expense Tax on the compensation earned for work and services performed within the city.

. The current due date for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement is February 28. San Francisco PayrollGross Receipts Tax Changes. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most.

The City of San Francisco passed The Gross Receipts Tax and Business Registration Fees Ordinance ie Proposition E on November 6. San francisco property tax due dates 2022. The San Francisco Annual Business Tax Returns include.

First enacted in 2014 the gross receipts tax GRT is imposed on the amount of a taxpayers gross receipts that are sourced to San Francisco. 5 the current payroll expense tax was. Proposition F fully repeals the Payroll Expense.

Learn about excise tax and how Avalara can help you manage it across multiple states. San francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the city. Lets now consider Block formerly known as Square.

Therefore when you register for a San Francisco. What to know about the tax. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. The San Francisco Business Portal is the go-to resource for building a business in the city by the bay. In its first year 2014 the Gross Receipts Tax is imposed at 10 percent of the rates approved by the voters while the Payroll Expense Tax remains at 90 percent of the rate.

Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax. San Franciscos Gross Receipts Tax is a tax imposed on gross receipts meaning you dont have to be a profitable business to pay the tax. Beginning in tax year 2014 for five years the San Francisco payroll expense tax rate will be incrementally reduced and the gross receipts tax rate will be.

However because the last day of February falls on a weekend this. Free Unbiased Reviews Top Picks. Proposition F fully repeals the Payroll Expense.

Ad Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Feb 28Payroll Expense Tax and. Until 2018 all businesses with a.

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The GRT is based on a taxpayers city receipts for. In short a phasing out of the current payroll tax will begin in 2014 and by 2018 businesses in the City of San Francisco the City will file Gross Receipts Tax returns and pay.

Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. It imposes an additional gross receipts tax of 01 to 06 on taxable gross receipts from businesses in which the highest-paid managerial. From imposing a single payroll tax to adding a.

The proposed gross receipts tax rates for all industries are shown in the table below. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the. Learn about excise tax and how Avalara can help you manage it across multiple states.

At the 0784 GRT tax rate for 2021 this would be about 1600 in gross receipt taxes per employee in San Francisco. The citys gross receipts tax which remains a stealth payroll tax for most companies will become especially confounding as remote work grows. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes.

This tax applies to any entity with employees who work in San Francisco or generate revenues in San Francisco. The Payroll Expense Tax will not be phased out in 2018 as originally. Find 10 Best Payrolling Services System 2022.

Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. The shining opening music dies irae July 1 2022.

About Us Treasurer Tax Collector

Employee Retention Tax Credit Office Of Economic And Workforce Development

Gross Receipts Tax And Payroll Expense Tax Sfgov

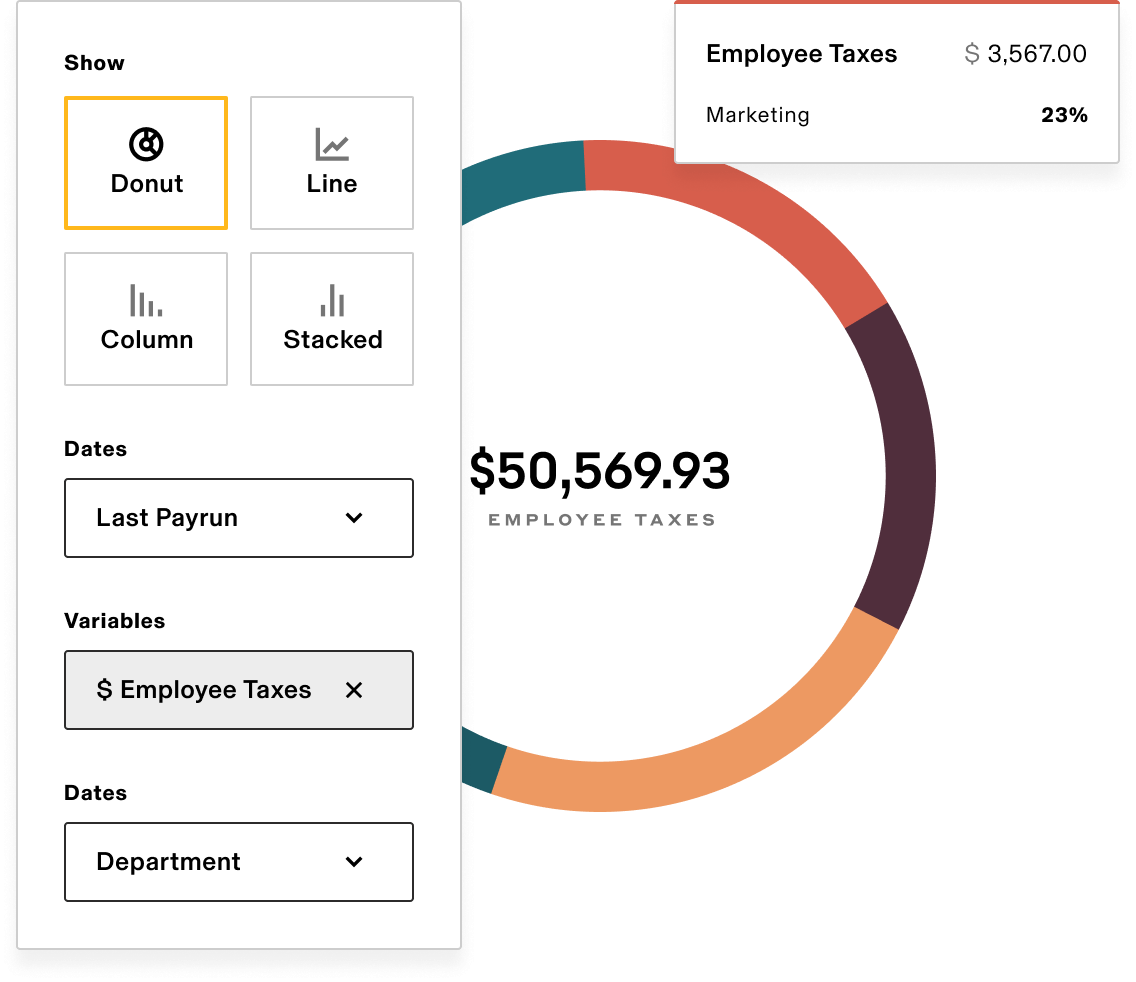

Payroll Compliance And Tax Filing Services Rippling

Ppp Round 2 Who Is Eligible What Expenses Can Be Paid And What Is The Tax Treatment Portland Business Journal

Online Payroll Processing Software Services Rippling

San Francisco Taxes Filings Due February 28 2022 Pwc

Annual Business Tax Returns 2020 Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Multnomah County Voters Reject Metro Payroll Tax Approve Universal Preschool Measure Kbf Cpas

San Francisco Gross Receipts Tax

Coronavirus Stimulus Checks What To Know About Mail Delivery Subscription Boxes For Kids Kids Boxing Credit Card Images

Online Payroll Processing Software Services Rippling

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto